This bill amends title ii old age survivors and disability insurance oasdi of the social security act for purposes of determining oasdi benefits to credit individuals who serve as caregivers of dependent relatives with deemed wages for up to five years of such service.

Social security caregiver credit act of 2017.

This bill amends title ii old age survivors and disability insurance oasdi of the social security act with respect to determining entitlement to and the amount of any monthly benefit including any lump sum death payment payable under oasdi on the basis of the.

The social security credits would be equal to the 50 of the average wages and self employment income for the time period when the caregiver provided assistance.

The caregiver would have to document expenses and the credit would be 30 percent of the eligible expenses above 2 000.

This bill amends title ii old age survivors and disability insurance oasdi of the social security act for purposes of determining oasdi benefits to credit individuals who serve as caregivers of dependent relatives with deemed wages for up to five years of such service.

Introduced in senate 05 25 2017 social security caregiver credit act of 2017.

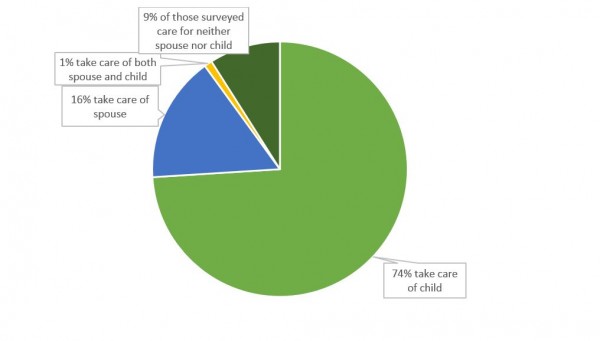

As the spouse or family member caring for a loved one who is seriously ill you can apply for social security benefits to help cover costs involved with being his or her caregiver.

796 the comprehensive long term care act of 2003 would expand medicare in a variety of ways including providing education and training for family caregivers to develop.

It also supports medical training programs for caregivers.

Eligibility depends on several factors such as financial need state of residence income and assets.

Social security caregiver credit act of 2017.

In govtrack us a database of bills in the u s.

Introduced in house 07 29 2015 to date there are 59 co sponsors in congress.

Titled the social security caregiver credit act of 2017 s 1255 the bill would credit individuals serving as caregivers of dependent relatives with deemed wages for up to five years of such service.

Among the bill s tax credit eligibility requirements a health care practitioner would have to certify that the loved one the caregiver is helping meets certain physical and cognitive needs.

Social security caregiver credit act of 2015.

A bill to amend title ii of the social security act to credit individuals serving as caregivers of dependent relatives with deemed wages for up to five years of such service and to support state medical training programs for caregivers.

Social security caregiver credit act of 2017.